Содержание

Later that day, at a press conference, a reporter revealed evidence that the Sacramento carpet-cleaning project didn't exist. More seriously, she'd discovered that ZZZZ Best did not have the contractor's license required for large-scale restoration work. To calm nervous investors, Minkow issued a press release touting record profits and revenues but did so without notifying Ernst & Whinney (now part of Ernst & Young), the firm responsible for auditing the company prior to the KeyServ deal. The press release also implied that Drexel had cleared ZZZZ Best of any wrongdoing, briefly stopping the decline. However, Drexel abruptly pulled out of the deal a few days later, causing the stock price to fall again.

Minkow made a deal with Padgett that he will pay him $100 every week for doing this. Padgett did what Minkow wanted him to do and this was the first success of Minkow in his big fraud scheme. Beyond the fact that the evaluate report isn’t a “signed writing,” the report itself particularly disclaims any proper to depend on the content material thereof such as the kind of “reliance” the Bank claims to have made on the report.

Zzzz Best Case: According To The Public Company

He was also plagued by customer complaints and demands for payment from suppliers. Faced with a shortage of operating capital, Minkow financed his business via check kiting, stealing and selling his grandmother's jewelry, staging break-ins at his offices, and running up fraudulent credit card charges. Why anyone on God’s green earth thought a carpet cleaning business, no matter how savvy or revolutionary, could become worth so much in so little time is a testament to the power of hype. In July researchers began to uncover the accounting fraud and short the company, and the stock plummeted from $18 to $3.50 a share.

The L.A. Times highlighted her story, which made ZZZZ Best's stock price decline pointedly. Lenders started to call their loans and more examinations initiated, unwinding Minkow's dark web of duplicity and fraud. Eventually, the truth behind the fictitious companies was revealed and the Ponzi scheme was uncovered. The business performed inadequately and 15-year-old Minkow was frequently immersed with customer objections and provider assortment demands. To make an illusion of a beneficial business, Minkow started carrying out criminal acts, for example, check kiting, theft, insurance scams, and fraud, to fund operations and pay providers. This caused a domino effect and ZZZZ Best was quickly outed as a Ponzi scheme.

Financial hall of shame: the biggest frauds in history - Capital.com

Financial hall of shame: the biggest frauds in history.

Posted: Tue, 05 Dec 2017 08:00:00 GMT [source]

The undersigned will be the only representative of this Firm present on the tour. To keep the business running, Minkow took loans from various dubious figures, and shuttled money between bank accounts, in a Ponzi-style scheme. As it relates to the assertion of occurrence and existence, third-party confirmations are usually highly reliable and auditors normally seek these out for a complete audit. Andersen, Woodland Hills, CA, Daniel E. Thus, it is difficult to determine, based only on the complaint, exactly what E Y alone is accused of doing. Morse was well versed in the building history and in the work scope for ZZZZ Best.

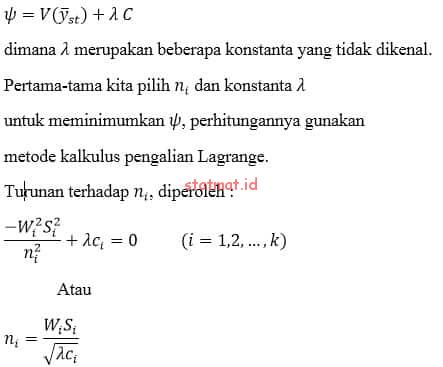

Church fraud guilty plea

Defendant E Y now brings this motion for Summary Adjudication on two completely separate grounds. First, E Y contends that Plaintiffs can’t base their Section 10/Rule 10b-5 declare on any of the publicly released statements, apart from the Review Report, because of the U.S. I agree with courtroom’s choice because Ernst & Whinney never issued an audit opinion on monetary statements it was only a evaluation report which was disclosed. The SAC, insofar because it considerations E & Y, is based upon the central allegation that E & Y was retained by ZZZZ Best Co. Inc. (“Z Best”) to perform a evaluation of the interim financial statements that Z Best had ready for the three month period ending July 31, 1986. The independence of Tom Padgett is at stake and a clash of interests can be identified when he knowingly seeks his interests at the expense of issuing true opinion of ZZZZ Best restoration contracts.

John Boyega has some ideas on how 'The Rise of Skywalker ... - Entertainment Weekly News

John Boyega has some ideas on how 'The Rise of Skywalker ....

Posted: Thu, 25 Aug 2022 07:00:00 GMT [source]

He failed to obtain sufficient evidence concerning the authenticity of restoration contracts that could have prevented the company from going public and swindling public investors. On March 16, 2011, Minkow announced through his attorney that he was pleading guilty to one count of insider trading. According to his lawyer, Minkow had bought his Lennar options using "nonpublic information." The plea, which was separate from the civil suit, came a month after Minkow learned he was the subject of a criminal investigation. Though unsolved, it was noted as suspicious due to Minkow's admitted history of staging burglaries to collect insurance money. He continued to profit from his short sales position due to sharp decreases in the reported company's stock price immediately after releasing a new report.

ZZZZ Best Company, Inc: Scope and Assurances of an Audit and Review

Ordinarily, the responsibility to disclose material facts does not come up absent a fiduciary relationship between the parties. (Goodman v. Kennedy 18 Cal.3d 335, 346–347, 134 Cal.Rptr. 375, 556 P.2nd 737.) No such obligation has been shown right here. A California appellate court recognized Ernst & Whinney not liable to Union Bank of California which allegedly relied on Ernst’s evaluate report in extending $ 7 million to ZZZZ Best Co. I agree with court’s decision because Ernst & Whinney by no means issued an audit opinion on financial statements it was only a evaluation report which was disclosed.

Earlier, he said that the $26 million restitution for the zzzz best inc 1986 alone was large enough that he would be writing restitution checks to the victims for the rest of his life. Lennar responded by adding Minkow as a defendant in a lawsuit against Marsch. Minkow was initially unconcerned, since he had prevailed before in similar cases on free speech grounds. According to court records, Minkow had shorted Lennar stock, buying $20,000 worth of options in a bet that the stock would fall.

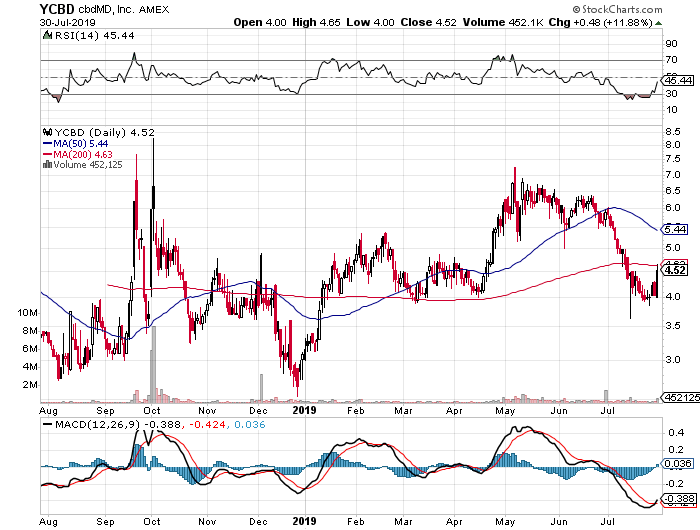

Beware Penny Stock Scams! | (Don't Fall for the Pump) (März

While RCA stayed in business, and continued to be a leader in radio for decades, its stock wouldn’t return to its 1929 valuation until the mid 60s. While the penny stock and “pink sheet” markets have seen their fair share of petty thieves peddle their worthless securities, even the big leagues of investing aren’t immune to scammers, pump-and-dumpers, and just complete scam artists. Minkow created two property management companies, the Interstate Appraisal Service and Assured Property Management. He also hired a well-known insurance agent, Tom Padgett, to be the principal officer of Interstate Appraisal Service and used these two companies to generate paper profit. Instead, Mr. Minkow focused his talents on getting capital for his company in any way he could. When he needed cash in 1984, he forged $13,000 worth of money orders from a Reseda liquor store.

- In testimony before Congress, George Greenspan reported that one means he used to audit the insurance restoration contracts was to verify that his client actually received payment on those jobs.

- According to his lawyer, Minkow had bought his Lennar options using "nonpublic information." The plea, which was separate from the civil suit, came a month after Minkow learned he was the subject of a criminal investigation.

- The nature of the "nonpublic information" became clear a week later, when federal prosecutors in Miami filed a criminal information charging Minkow with one count of conspiracy to commit securities fraud.

- However, the capital was a major issue and he soon started undertaking credit card forgeries alongside other frauds that provided his initial capital.

Shareholders got wiped out by the bankruptcy and by the time the scam had fully unraveled, investor losses amounted to more than $100 million. Minkow was able to get big loans from Banks by showing them the insurance restoration contacts. After successfully receiving loans from banks, Minkow decided to focus more on loans restoration contracts.

He was also placed on five years' probation and ordered to pay $26 million in restitution. District Court Judge Dickran Tevrizian described Minkow as a man without a conscience, rejecting his plea for a lighter sentence as "a joke" and "a slap on the wrist" for someone who had manipulated the financial system. The SEC subsequently banned him from ever serving as an officer or director of a public company again. He served under seven and a half years, most of them at Federal Correctional Institution, Englewood.

( ZZZZ Best Company, Inc_caen-sccm-cdp01.engin.umich.edu

ZZZZ Best’s 80 percent of the revenue was from insurance restoration contacts. Minkow reduced his carpet cleaning services and started taking more and more loan from banks and he was successful in that with the help of his friend Padgett. After this huge success ZZZZ Best became a big firm from a very small carpet cleaning company. Within hours of the story's publication, ZZZZ Best's banks either called their loans or threatened to do so.

The story, which ran just days before the merger was to close, sent ZZZZ Best stock plunging 28 percent. With the help of Tom Padgett, a claims adjuster, Minkow forged numerous documents claiming that ZZZZ Best was involved in several restoration projects for Padgett's company. Padgett and Minkow formed a fake company, Interstate Appraisal Services, that verified the details of these restorations to Minkow's bankers.

The https://1investing.in/, which was based in Reseda, California, initially started out as a legitimate business but eventually became embroiled in one of the most infamous cases of corporate fraud in U.S. history. Barry Minkow founded ZZZZ Best in his parents’ garage in 1982 when he was only sixteen years old. Due to high competition in the industry, low enter barriers, and bad internal control, this young entrepreneur started to have cash flow problems, and a shortage of working capital. Ernst & Whinney argue subsequent that even if the bank did depend on its report in making the loan such reliance was unreasonable as a matter of legislation.

He seemed like a model young entrepreneur, except for the fact that he never actually ran a profitable business. This is a digitized version of an article from The Times’s print archive, before the start of online publication in 1996. To preserve these articles as they originally appeared, The Times does not alter, edit or update them. A California appellate court docket acknowledged Ernst & Whinney not liable to Union Bank of California which allegedly relied on Ernst’s evaluate report in extending $ 7 million to ZZZZ Best Co. However, Drexel abruptly pulled out of the deal a number of days later, inflicting the inventory value to fall again. Drexel’s withdrawal stopped the deal 4 to seven days before it was due to close.

ZZZZ Best was an excellent company on paper and at one point was valued over a quarter billion dollars, then bankrupted shortly afterward. To launch an IPO, the Securities and Exchange Commission requires a firm to compile a prospectus, which must include a set of audited financial statements. Independent certified public accountant firm Ernst & Whinney (now Ernst & Young) audited ZZZZ Best's financials to provide an opinion as to whether the financial statements were free of material misstatement. On January 22, 2014, Minkow pleaded guilty to one count each of conspiracy to commit bank fraud, wire fraud, mail fraud and to defraud the federal government. He admitted to embezzling over $3 million in donations to Community Bible Church from 2001 to 2011.

He also acted unethically more so in his involvement in misrepresenting banks and other creditors that relied on his opinion to advance credit to the company. Shareholders in ZZZZ Best were wiped out by the bankruptcy, although they did win a settlement of $35m from the firm's auditors, Ernst & Whinney. One big red flag that things were not how they seemed was that Minkow employed convicted criminals as senior executives. His chief financial officer stayed in place even after being accused of stealing money from customers of his previous firm. For his part, Minkow didn't seem to learn his lesson and was jailed in 2011 for insider trading. ZZZZ Best was a carpet-cleaning company set up in Inglewood, California in 1982 by the then 16-year-old Barry Minkow, while he was still in school.

It was a convincing show, and the auditor gave ZZZZ Best a clean bill of health. In Union Carbide, the accountants, Morgan Stanley, argued that a financial forecast issued by Union Carbide could not be attributed to Morgan Stanley for Rule 10-5 purposes as a result of it did not itself announce the projections. However, the court held that as a result of Morgan Stanley ready the financial projections and totally participated in the fraud, the misstatements might be attributed to Morgan Stanley.