Contents:

The company offers Chicago-style hot dogs and sausages, Italian beef sandwiches, char-grilled burgers, chopped salads, crinkle-cut French fries, homemade chocolate cakes, and chocolate cake shakes. As of March 10, 2022, it operated in 70 locations across nine states. Portillo's Inc. was founded in 1963 and is based in Oak Brook, Illino... Portillo's Inc. (Portillo's) is a restaurant company that serves Chicago Street food.

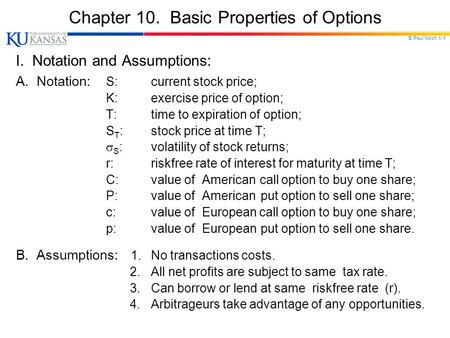

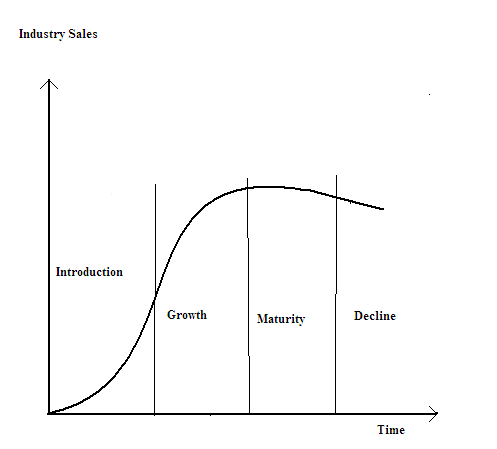

The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give where mergers go wrong an advantage in earnings season. The scores are based on the trading styles of Value, Growth, and Momentum. There's also a VGM Score ('V' for Value, 'G' for Growth and 'M' for Momentum), which combines the weighted average of the individual style scores into one score. Portillo’s IPO took place on the 22nd of October 2021, when the company stock went public on the NASDAQ stock exchange. Besides looking at Portillo’s fundamentals, you can use technical analysis to evaluate the company and identify trading opportunities in price trends and patterns seen on charts.

Portillo's drive-thru locations go cashless

Pratt said it is targeting one or two new restaurants locally each year, depending on the real estate market. Get a powerful and robust data suite tailored to your investing style, complete with stock ideas, portfolio alerts and management and customizable screens to help you find the perfect investment. It stands for Earnings before Interest, Taxes, Depreciation, and Amortization. It attempts to reflect the cash profit generated by a company’s operations. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

- MarketBeat has tracked 2 news articles for Portillo's this week, compared to 2 articles on an average week.

- Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure.

- Portillos Inc - Ordinary Shares - Class A 52 week low is $14.84 as of April 11, 2023.

- If the share price of a stock you’re interested in is financially out of reach, you can also explore fractional shares.

Once you decide on the number of https://1investing.in/ or the dollar amount you’d like to purchase, you can place your order. If you’re working with an advisor, tell them you’d like to buy Portillo’s stock and how much you can invest, and they’ll do it for you. If using a brokerage account, simply log in and enter the ticker PTLO in the search bar.

For Business

However, if you have your own broker account, simply log on, navigate to the stock’s detail page, input the number of shares or dollar amount you want to offload, and tap sell. You can sell Portillo’s stock if you see the company performing differently than expected or after reaching your desired financial goal. You want to keep sporadically inspecting the company’s performance by checking the same annual and quarterly reports you used to conduct your preliminary research. Thanks to various online brokers, access to the stock market has never been more accessible as well as affordable. However, choosing the right broker optimized for your needs is critical for a stress-free trading experience.

Market Cap is calculated by multiplying the number of shares outstanding by the stock's price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company's dividend expressed as a percentage of its current stock price. Portillo's Inc. owns and operates fast casual and quick service restaurants in the United States. The company offers Chicago-style hot dogs and sausages, Italian beef sandwiches, burgers, chopped salads, crinkle-cut French fries, homemade chocolate cakes, and milkshakes.

High institutional ownership can be a signal of strong market trust in this company. In the past three months, Portillo's insiders have sold more of their company's stock than they have bought. Specifically, they have bought $0.00 in company stock and sold $353,645.00 in company stock. MarketBeat has tracked 2 news articles for Portillo's this week, compared to 2 articles on an average week. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Price/sales represents the amount an investor is willing to pay for a dollar generated from a particular company’s sales or revenues.

Portillo’s IPO

Portillo's stock was originally listed at a price of $29.10 in Oct 21, 2021. If you had invested in Portillo's stock at $29.10, your return over the last 1 years would have been -29.55%, for an annualized return of -29.55% . Meanwhile, opened at $15.37, slightly higher than the offering price of $15, but closed nearly 10% off that mark. "We'll see whether they'll be able to take this Chicago-style dog and burger concept from the regional market to the national market and potentially international," said Sean Dunlop, equity analyst at Morningstar.

The initial $20-a-share valuation was at the high end of a proposed $17-to-$20 range and gives Portillo’s a market value of about $1.4 billion. Data are provided 'as is' for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. Sign up to receive texts from Restaurant Business on news and insights that matter to your brand. Portillo’s is preparing to open a half-size restaurant this winter in Joliet, Ill., that includes three drive-thru lanes but no indoor seating. The 3,750-square-foot prototype “opens up a lot of new avenues for us,” the chain’s VP of real estate previously told Restaurant Business.

Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an "uptick" in price and the value of trades made on a "downtick" in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Price/book ratio can tell investors approximately how much they’re paying for a company’s assets, based on historical, rather than current, valuations.

Sign Up NowGet this delivered to your inbox, and more info about our products and services. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer. The company is scheduled to release its next quarterly earnings announcement on Thursday, May 4th 2023. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time.

Warren Buffett Finally Throws In The Towel On 4 Lousy Stocks - Investor's Business Daily

Warren Buffett Finally Throws In The Towel On 4 Lousy Stocks.

Posted: Wed, 17 Aug 2022 07:00:00 GMT [source]

PTLO stock is off to a strong start today with shares up 52.2% and some 10 million units traded. The Portillo’s IPO includes 20,270,270 shares of its common stock. The Shares started trading at $26.10 each, which is well above the planned IPO price of $20 per share. If you're looking for even faster potential return on a stock going public, check this out... Fast food might be a struggling market at the moment, with labor shortages and supply chain problems. This past year, it invested in a platform called Cartwheel, which helps with mobile orders and deliveries.

The company estimated its third quarter revenue will be $138 million, up 15% from the same period a year ago. It said its net income would be about $6 million, compared with $8.1 million for the third quarter of 2020. Portillo’s attributed the decline to higher costs for labor and ingredients, especially beef, and expenses for the opening of five new restaurants.

The Company owns and operates approximately 72 restaurants across nine... EV / Sales ,10x EV / Sales ,85x Nbr of Employees Free-Float 79,8% More FinancialsCompanyPortillo's Inc. (Portillo's) is a restaurant company that serves Chicago Street food. Portillo’s is best known for its Chicago-style hot dogs, Italian beef sandwiches, char-grilled burgers, fresh salads and famous chocolate cake.

Portillo’s files for its IPO - Restaurant Business Online

Portillo’s files for its IPO.

Posted: Mon, 27 Sep 2021 07:00:00 GMT [source]

In fact, Portillo's "Chocolate Cake Shake" is famous for containing a whole slice of chocolate cake. It's made rounds on the Internet for containing mayonnaise as a secret ingredient. Turns out, that's just a well-known way of adding moisture to any chocolate cake. Portillo's was founded by Dick Portillo as a hot dog stand called "The Dog House" in 1963. Here's more on why you should look into buying the stock sooner or later. If you aren't doing this a couple times a week, you need to start.

No comments.